Executive Summary:

- TRS Board of Trustees considering moving investment return assumption to 7 percent

- A vote on the matter will likely occur in July or September

- TRTA continues to push for a COLA for retired educators

- Senate Finance Committee set to meet May 4th to review inflation pressure on Texas economy. TRTA members are encouraged to watch or come to the Capitol. See our Facebook post here.

The Teacher Retirement System of Texas (TRS) held a Board of Trustees meeting on April 28 and April 29. The key point of discussion during the meeting was the pension plan’s investment return assumption.

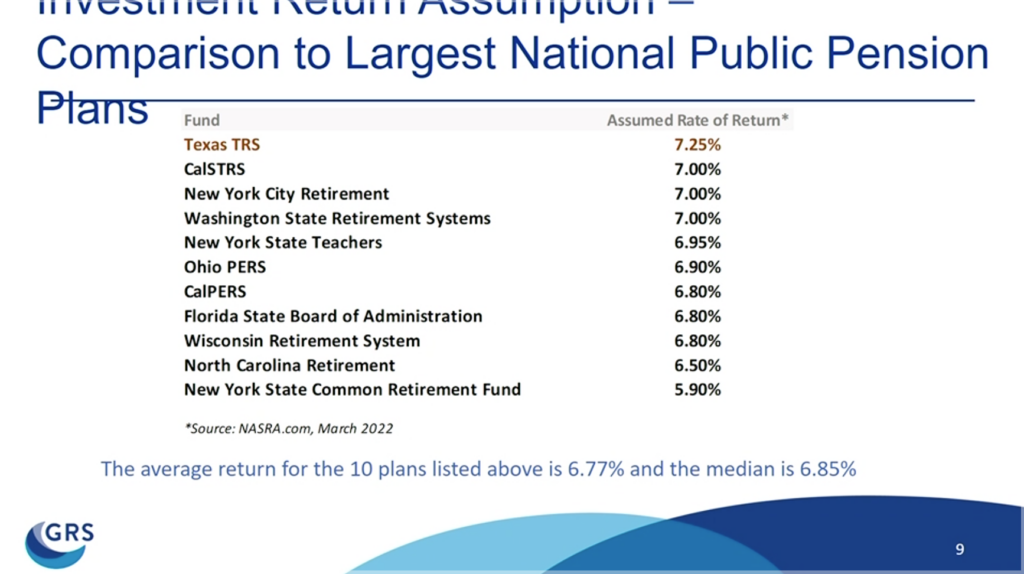

The investment return assumption is a projection of how much TRS expects its investments to make over time. The current investment return assumption is 7.25 percent, and the Board of Trustees is taking up a consideration to move it down to 7 percent. The board will likely vote on this consideration either during its July or September meeting.

The prospect of reducing the investment return assumption is significant for retired educators because it potentially increases the timeline of when TRS projects it will pay off its unfunded liability. The Texas Legislature uses this information when deciding whether to provide retirees with a much-needed cost-of-living adjustment (COLA).

Gabriel, Roeder, Smith (GRS), the actuarial firm who generates the experience study, projects that changing the investment return assumption to 7 percent will move back the funding period from 23 to 26 years. The funding period must be below 31 years to allow for a benefit increase according to Texas statute.

TRS trustees, though, do have some options that may mitigate the impact this change will have on the amortization period. Thanks to the outsized 25 percent return on investments in 2021, which represents more than $21 billion in gains, the board is considering the option of recognizing a portion of those gains to minimize the impact to the actuarial funding period. Typically, TRS will use a time horizon of five years to recognize outsized gains or losses to avoid wild swings in funding or asset management policy when the market experiences abnormal fluctuations. This process is known as “smoothing.”

GRS suggested to the board the possibility of making the change to 7 percent and recognizing $5 billion in deferred gains now to keep the funding period around 22 years.

TRS trustees discussed that going into the legislative session with a shorter amortization period and a more updated set of assumptions for trust fund management may provide the Legislature more flexibility on the topic of a COLA for retirees.

Tim Lee, the Texas Retired Teachers Association’s (TRTA) Executive Director, addressed the TRS board during public testimony. He stressed the need for TRS to work with the Texas Legislature to help provide retirees with a COLA. He highlighted the fact that retirees are suffering from hyperinflation. TRS annuitants who retired after Aug. 31, 2004, have never received a COLA.

Joe Newton, lead consultant with the actuarial firm, highlighted that many of TRS’s peers use an investment return assumption of 7 percent. Newton pointed to reducing the investment return assumption to be a national trend. He said that any consideration of a COLA for retirees should be paired with increased contributions from the Texas Legislature.

In 2019, TRTA worked with the Texas Legislature to pass a hallmark bill, SB 12, that provided additional funding from all parties to help make TRS actuarially sound. This plan included a phase-in of additional revenue for TRS pension fund.

Last session, TRTA helped ensure that the state budget maintained the contribution levels promised in SB 12. This was a great victory for all TRS members as it added more than $1 billion for TRS and kept the system actuarially sound even in the middle of the dire pandemic.

In addition, the Legislature passed a supplemental payment for retirees capped at $2,000 in 2019 and another supplemental payment capped at $2,400 in 2021. TRTA members worked tirelessly on these efforts and are extremely grateful for the work done by the Legislature to help TRS retirees and pre-retirees.

TRTA members are focused on a COLA for TRS retirees in the coming session. We will follow the discussion on the pension fund assumptions and provide meaningful input in this process to help ensure the most options are available to the Texas Legislature as we look ahead to the next session.

¡Gracias!

Stay tuned to the Línea interior for more information about issues that impact Texas public education retirees.

¡TRTA es el único grupo que se enfoca únicamente en su seguridad de jubilación TRS! Únase a nosotros hoy!

Thank you for being a member of TRTA and supporting issues that affect retired Texas public school personnel. Be sure to download the TRTA app to receive all of the latest updates and communicate with your fellow retirees.