Executive Summary:

- Cost projections on Texas providing a cost-of-living increase for retirees were presented at the TRS Board of Trustees meeting.

- TRTA is advocating for the Texas Legislature to provide retirees with a substantial, meaningful COLA in 2023.

- TRS investment returns lost 6.7% in 2022.

- Despite this year’s downturn, the investment returns over the past five years have still been net positive by 7.3%.

Members of the Texas Retired Teachers Association (TRTA) are asking three questions: Will the Legislature approve a cost-of-living adjustment (COLA) in 2023? What percentage increase would a potential COLA be? If passed, when will the COLA be implemented?

Today, the Teacher Retirement System of Texas (TRS) Board of Trustees met and received a presentation that provided a glimpse into what the answers to those questions may look like. The 2022 actuarial valuation of the pension trust fund included information about how the Texas Legislature could fund a COLA for retirees.

TRTA is advocating for a substantial, meaningful COLA for retirees that doesn’t negatively impact the TRS pension fund. The details of what this COLA may look like and how it’s funded will be decided by Texas legislators during the 2023 legislative session, which convenes in January.

The Legislature can best accomplish the task of providing retirees with a COLA by engaging with TRS members. TRTA is here to be a trusted advocate, but ultimately only the Legislature can approve a COLA and determine the means for paying for it. There are many resources available to the Legislature including the General Revenue fund, the Economic Stabilization Fund (also known as the “Rainy Day” Fund), the TRS pension fund, and contributions from the state, school districts, and/or active employees.

Editor’s note: Based on TRS data, approximately every 1 percent increase that retirees would receive projects to be about $1 billion in additional costs that would need to come from the available funding sources.

There are potentially many options available to help retirees, and TRTA anticipates we will be engaged regularly during the session with the ideas that legislators bring to the table.

TRTA members, please be aware that we do not have any guarantees on what direction the Legislature will take on this issue at this time. We are asking all current TRS retirees to join TRTA and help in our effort to win a COLA.

TRTA will report on any legislation that is filed and considered once the session begins and as it continues through May 2023. Please stay tuned to the Línea interior for these important updates and any pressing Action Alerts where we ask for your direct participation in contacting your legislators!

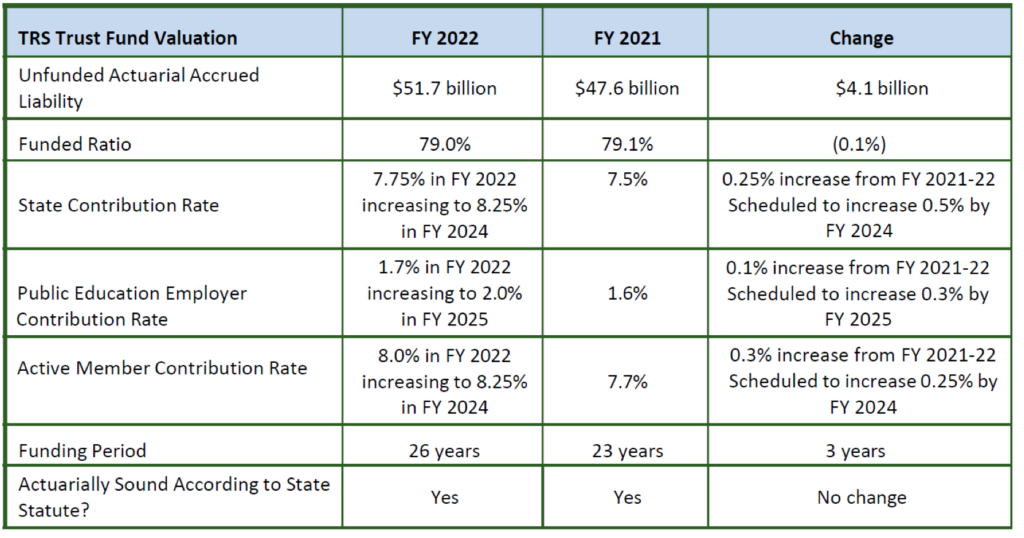

Pension Fund Valuation

Joe Newton and Dana Woolfrey of Gabriel, Roeder, Smith, & Co. presented the actuarial valuation of TRS pension fund for the fiscal year ending August 31, 2022. The valuation serves as a health checkup for the pension fund. A valuation will occur again in February and be presented to the Legislature, which will be important when legislators consider possible benefit enhancements like a cost-of-living adjustment (COLA).

Woolfrey reported that TRS market investment returns for 2022 were negative 6.7 percent. Returns were approximately positive 7.3% over the last 5 years, 8.1% over the last 10 years, and 7.8% last 20 years.

The current value of pension fund based on smoothed assets is $193.9 billion and based on market value is $184.2 billion. This is compared to a market value of $201.8 billion for the fiscal year ending August 31, 2021.

The funding period, which is the period of time necessary to amortize the unfunded actuarial accrued liability (UAAL), has increased from 23 years to 26 years. Even with the increase to the funding period, the projected date of full funding is still in line with the Senate Bill 12 (passed during the 86th Legislative Session) projections from 2019. Based on current assumptions, the TRS Pension Fund would reach 100 percent funded status in 2048. The current funded ratio is 79 percent.

Additionally, the TRS pension fund meets the statutory definition for actuarial soundness by having a funding period of less than 31 years. This is the standard that must be met before the Legislature can approve a benefit increase for TRS retirees.

The unfunded liabilities increased from $47.6 billion in 2021 to $51.7 billion in 2022. The primary reasons for the increase were investment performance for fiscal year 2022 and higher-than-expected salary increases across the active population. It is projected the unfunded liabilities will continue to increase slightly over the next five years before beginning to decline.

Below is a comparison of the 2022 actuarial valuation to the 2021 actuarial valuation.

Newton discussed how an increase in contributions to the pension fund would drastically reduce the fund’s unfunded liabilities and funding period. For example, a 1 percent contribution increase could reduce the funding period by five years.

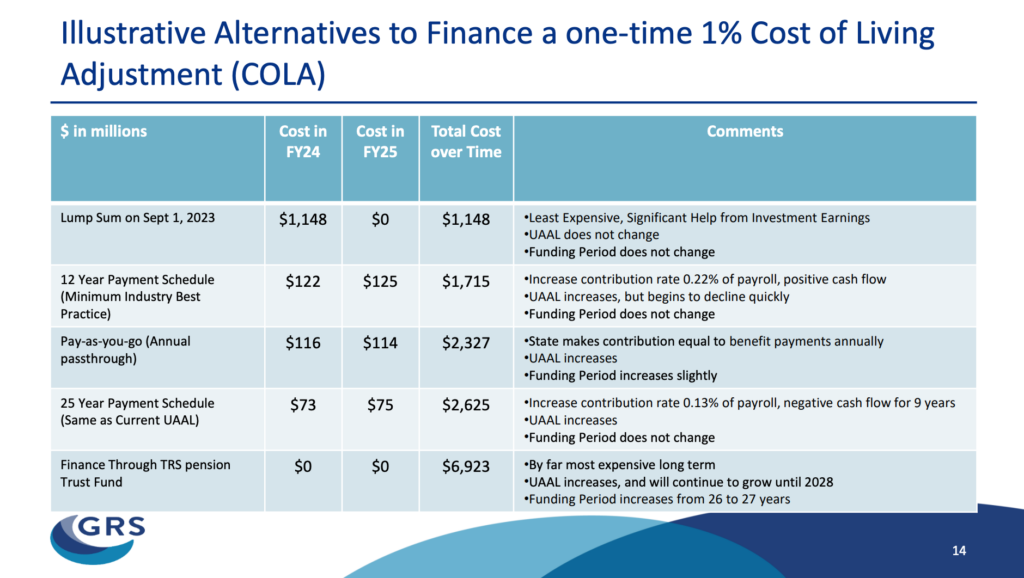

Newton reviewed scenarios for how the pension fund would be affected if it were to finance a cost-of-living adjustment (COLA). Below is a chart that demonstrates how the pension fund would be affected if a COLA of one percent were financed.

Newton recommended that if a benefit enhancement is passed this coming session, a corresponding increase in revenue should come with it, consistent with industry best practices for managing pension funds. The top two funding methods in the above chart demonstrate the actuary’s recommendations for funding a COLA. Newton noted that the numbers in the chart can be multiplied to show the total cost of a COLA based on a higher percentage benefit increase. For example, multiplying the numbers in the chart by 5 demonstrates a 5 percent COLA.

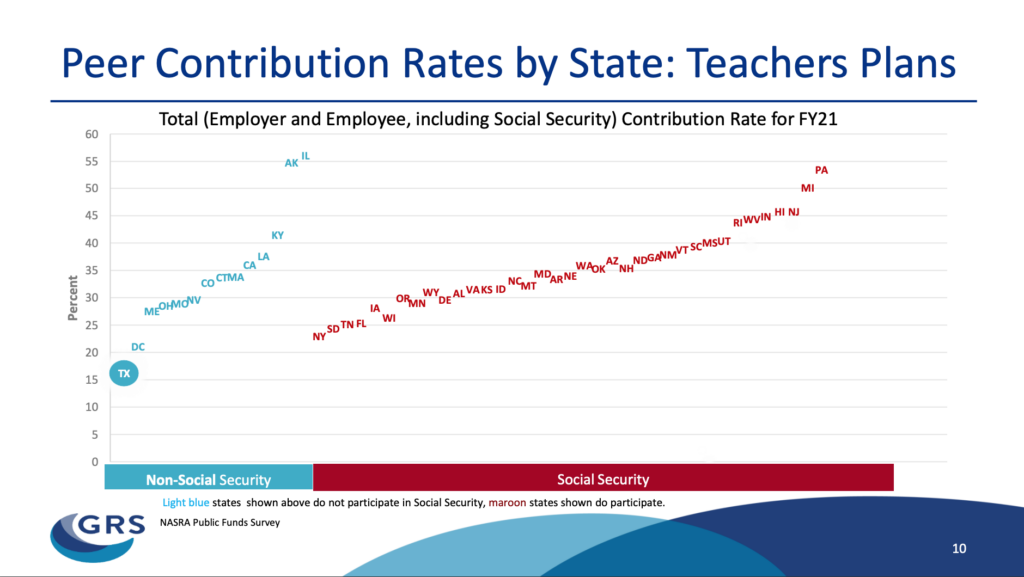

TRS Contribution Rates Lag Far Behind Other States

During his presentation, Joe Newton emphasized that compared to other states, contributions to Texas TRS are significantly lower than contributions to teacher pension plans in other states. The chart below illustrates that comparison. In Texas, there is a constitutional minimum imposed on contributions to the TRS pension fund.

The states listed in red all participate in Social Security. The states in red have an inflation adjusted COLA as a part of their retirement system. All the states in blue don’t pay into Social Security. The states in blue include an automatic or inflationary trigger for a COLA. Texas is the exception. Texas doesn’t have any inflationary triggers for a COLA. Texas relies upon the Legislature to make ad-hoc adjustments.

TRS Facilities Update

TRS Executive Director Brian Guthrie reported that TRS’s first regional office opened in El Paso on November 14, 2022. The office is located within the Region 10 Education Service Center and is proving to be valuable to TRS members who are not able to travel long distances to the Austin headquarters office. Guthrie also reported that construction is on schedule for the new TRS headquarters building in the Mueller district of Austin.

¡Gracias!

Thank you for being a member of TRTA and supporting issues that affect retired Texas public school personnel. Be sure to download the TRTA app to receive all of the latest updates and communicate with your fellow retirees.

¡TRTA es el único grupo que se enfoca únicamente en su seguridad de jubilación TRS! Únase a nosotros hoy!