Tim Lee, the Texas Retired Teachers Association’s (TRTA) Executive Director, will be live on Facebook and YouTube tomorrow, March 2, at 4 p.m. Central.

The pace of legislative activity is picking up, and Lee will be discussing this week’s committee meetings! He will also focus on the challenges ahead!

PIFS Committee Meets

The Texas House Pensions, Investments, and Financial Services Committee (PIFS) met today, March 1 for an organizational meeting and heard testimony from the Teacher Retirement System of Texas (TRS). There was no public testimony at this meeting.

TRS Executive Director Brian Guthrie made a presentation to the committee, providing an overview of the pension trust fund, the TRS-Care retiree health insurance program, and the TRS Active-Care health insurance program.

He reminded committee members that 96% of TRS retirees do not earn Social Security benefits. TRS is often their sole retirement benefit. The TRS pension trust fund provides current and future retirement benefits for over 1.9 million individuals, including nearly 476,000 annuitants and nearly 1.5 million active employees. TRS has 294 retirees over the age of 100, with the oldest being 109. One in 20 Texans is a member of TRS.

Guthrie shared with the committee members that TRS is the 5th largest defined benefit plan in the United States and in the top 20 in the world. The fund is expected to earn an average long-term return of 7% per year, which is the actuarial investment return assumption. This equates to $13 billion annually, or $51 million every business day of the year. Guthrie stated that the goal is to diversify the fund to weather market volatility.

TRS paid $12.9 billion to TRS retirees in fiscal year 2022. More than 60% of the value of the fund comes from investment returns, while the remaining value stems from contributions from the state, active employees, and school districts.

Most TRS retirees remain in Texas after retiring and spend their annuities in the economy, creating a multiplier effect. Every $1 in benefits paid by TRS generates $2.35 in economic activity.

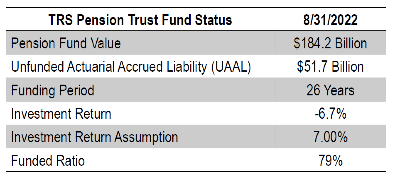

As members of the Texas Retired Teachers Association (TRTA) may recall, TRS will reveal the results of its February 28 fund valuation soon, and those figures will help determine the actuarial soundness of the fund. The chart below shows the pension fund’s status as of August 31, 2022.

During his testimony, Guthrie said, “There are a number of our members who have said they are interested in receiving something this session,” referring to a cost-of-living adjustment (COLA) or supplemental payment for TRS retirees.

Guthrie also referred to a rider including in the preliminary version of the state budget that states the Legislature’s intention to provide some form of benefit enhancement for TRS retirees this session provided the pension fund is actuarially sound. “We’re working with all of you to see what we can do to help in that process,” said Guthrie.

As Guthrie has stated in previous meetings with members of the Legislature, as a rule of thumb, the cost of a one percent COLA across the board is approximately $1.1 billion. This figure is scalable, meaning that a 3% COLA would cost approximately $3.3 billion.

He told committee members there are many options for structuring a COLA, depending upon “what your policy goals are,” adding that “there are a variety of ways to finance this.”

COLAs or supplemental payments can be paid for upfront by the Legislature or financed over a period of time through the pension fund itself.

Financing benefit enhancements through the fund is the most expensive option, said Guthrie, as it is paid for over time. Conversely, the supplemental payments provided to TRS retirees in 2019 and 2021 were prefunded by the Legislature.

Thank you for being a member of TRTA and supporting issues that affect retired Texas public school personnel.

TRTA is the only group that focuses solely on your TRS retirement security! Please join us today!