Executive Summary:

- TRTA testified to the Senate Finance Committee that the state should invest in retirees by passing a COLA.

- TRS provided data to the committee about what the costs would look like to pass a COLA.

- TRTA will continue to work with legislators to win a COLA.

The Senate Finance Committee of the 88th Texas Legislature met on Monday, February 6, 2023 to begin discussions on Senate Bill 1, the general appropriations bill. The hearing included a presentation from the Teacher Retirement System of Texas (TRS). The Texas Retired Teachers Association (TRTA) also provided public testimony during the hearing.

Currently, Senate Bill 1 has approximately $7.25 billion appropriated for TRS for 2024-2025. Senate Bill 1 also has budget Rider 21 that states “it is the intent of the Legislature that a benefit enhancement be provided to TRS retirees, contingent on the determination that the TRS Pension Trust Fund is considered actuarially sound pursuant to Government Code, Section 824.2031.”

TRTA supports passing a substantial and meaningful cost-of-living adjustment (COLA) for TRS retirees. Inflation is at its highest level in 40 years and TRTA members are working this session to pass a COLA and other benefit enhancements to help all TRS retirees.

“Inflation is the enemy for TRS retirees living on fixed incomes,” said TRTA Executive Director Tim Lee at the Finance Committee hearing. “Retirees do not understand why they have to suffer when the state has a substantial surplus,” said Lee about the $32.7 billion surplus the state budget writers have available to address the numerous needs facing Texas.

Lee thanked legislators for their continued commitment to funding the TRS pension fund over the years, saying that the passage of SB 12 in 2019 “was a watershed moment.” He also expressed that TRTA members are grateful to Legislature for passing supplemental checks to help retirees in 2019 and 2021.

He reiterated that inflation has had a “deep and lasting impact” on retirees’ financial security.

“We look at a COLA as an investment,” said Lee. “TRTA is asking for a seat at the table” as discussions about possible benefit enhancements occur this session.

TRS Data, Facts, and Figures

TRS Executive Director Brian Guthrie made a presentation to the committee members, reminding them that the TRS Pension Trust Fund provides current and future retirement benefits for over 1.9 million individuals, including nearly 476,000 annuitants and nearly 1.5 million active employees. Approximately 96% of public educators do not earn Social Security.

Actuarial valuations of the pension fund are prepared annually, as of August 31 of each year. However, during legislative years, a February 28 valuation update is also provided. The February 28, 2023 valuation will be a major consideration when the Legislature reviews options for providing TRS retirees with a potential COLA. At that time, information will be made available about the system’s actuarial soundness.

State law does not define actuarial soundness; but, it does say that benefit enhancements for retirees cannot be made if the system funding period is over 31 years or if the benefit enhancement would push the system to a funding period beyond 31 years. The statutory provisions on how benefit enhancements may be authorized is commonly referred to as the actuarial soundness of the pension system.

As of August 31, 2022, the funding period for TRS was 26 years. The February 28 valuation will help guide decision makers on TRS policy for the coming biennium. Factors that can impact the system’s actuarial condition as of February 28 include recent investment returns.

“We are prevented from even discussing a benefit enhancement if the fund is not actuarially sound,” said Director Guthrie. As of last week, the fund value is at $186 billion, close to a three percent return for the first six months of the year. “We do believe that we will meet that threshold,” added Guthrie. The fund value would have to fall to $155 billion or less to cause the system to not be sound.

Guthrie reviewed scenarios for how the pension fund would be affected if it were to finance a COLA. “We can’t come up with a good estimate of what a benefit enhancement will cost” until the February 28 valuation, per Guthrie.

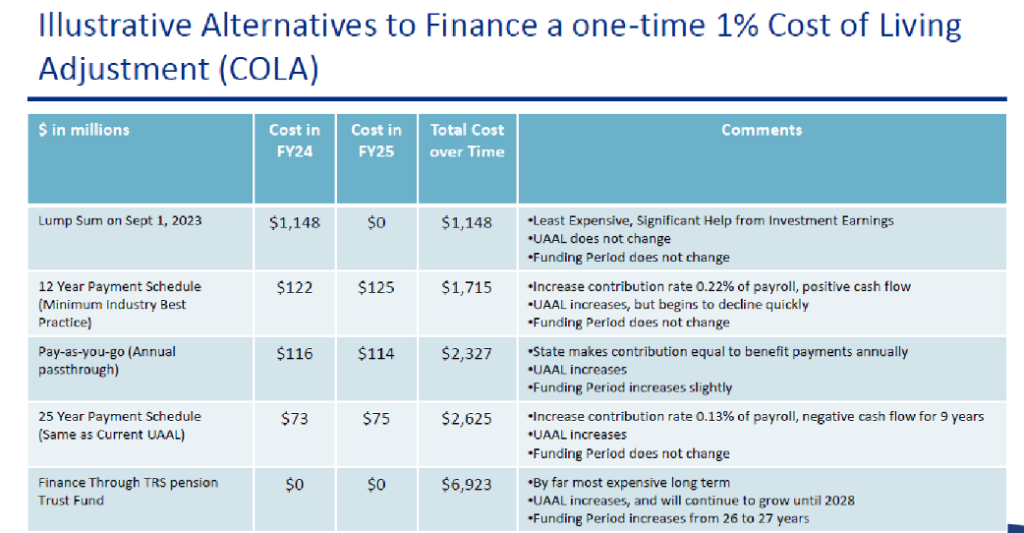

Below is a chart that demonstrates how the pension fund would be affected if an uncapped COLA of one percent were financed. Guthrie noted that the numbers in the chart can be multiplied to show the total cost of a COLA based on a higher percentage benefit increase. For example, multiplying the numbers in the chart by 5 demonstrates a 5 percent COLA. Guthrie stated the chart is meant to be used as a means to start the dialogue about how to fund a possible benefit enhancement.

TRTA members should know that there are a variety of ways a COLA could be funded including using the state’s General Revenue fund to prefund a benefit enhancement, amortizing it through the pension fund itself, increasing contributions to the fund, using the Rainy Day Fund, or any combination of these methods. Historically, COLAs have been financed through the pension fund, Guthrie reminded the committee members, and this method increases the fund’s liability and impacts its actuarial soundness.

Senator Zaffirini asked about the impact of providing COLAs for TRS retirees versus supplemental payments. Supplemental payments provide more funds immediately, but those funds do not continue over time. Senator Kolkhorst asked how long it would take a retiree earning $24,000 per year to reap the same amount from a COLA that they would receive from a one-time supplemental payment (approximately 10 years). She said it is important to consider this question when reviewing options for helping retirees.

Craig Campbell, a member of TRTA and the Austin RTA testified, said “pension payments are an investment in Texas communities.”

“Retirees spend their money in every local grocery store . . . in the state,” said Campbell. “I ask that you show compassion.” He emphasized that older retirees had smaller incomes while working and need a larger percentage COLA.

What’s Next?

The Senate budget proposal is moving in the right direction. TRTA is working closely with legislative leaders on our agenda this session. We want to thank Lieutenant Governor Dan Patrick, Senate Finance Chair Joan Huffman, and all the Senate Finance Committee members for including full funding for the TRS pension fund and the TRS-Care health insurance program in the base budget.

Our commitment to all TRTA members is that we are working to win you a COLA. We have a long way to go this session and as we have reported in the past, there are many groups and organizations competing for the same funding we are trying to win for TRS retirees. We must stand together and stay focused on winning the most we can for TRS retirees.

TRTA members can use these helping COLA talking points, which can be downloaded here, when communicating with their Texas State Senators and Representatives about the importance of passing a much-needed COLA for our public education retirees during this legislative session.

The points include useful facts about inflation, the positive impact TRS retirees have on the state economy, and how the TRS system here compares to that of systems in other states.

TRTA is working hard at the Texas Capitol every day and relies on the grassroots advocacy efforts of our members to help spread the message to every legislator that TRS retirees need a raise!

Members, please use the talking points when reaching out to your legislators, and be sure to follow Tim Lee’s 10 helpful tips for the 88th Legislative Session.

Thank You

Thank you for being a member of TRTA and supporting issues that affect retired Texas public school personnel.

TRTA is the only group that focuses solely on your TRS retirement security! Please join us today!