The Teacher Retirement System of Texas (TRS) Board of Trustees convened on December 5 and 6 for their quarterly meeting. Among the topics discussed were the actuarial valuation of the pension fund for fiscal year 2024, which serves as “health checkup” of the system.

The valuation helps to determine the adequacy of current statutory contributions, explains any changes in the fund’s actuarial condition and the impact on the fund’s Unfunded Actuarial Accrued Liability (UAAL) and its funded status, and provides information about any possible future issues.

Another valuation will be performed in February 2025, which will be used by the Texas Legislature to assess the status of the pension fund and determine how legislation could impact it.

The valuation was performed and presented by the firm Gabriel, Roeder, Smith, and Company (GRS). It is important to note that the cost-of-living adjustments (COLAs) and stipends passed in 2023 for TRS retirees did not impact the fund as they were paid for out of state general revenue.

Annual market returns have been volatile from year-to-year but have met the TRS assumption over the past decade. TRS had a 12.7% rate of return for 2024. The strong 2024 market performance offset most of the remaining investment experience from 2022 and 2023.

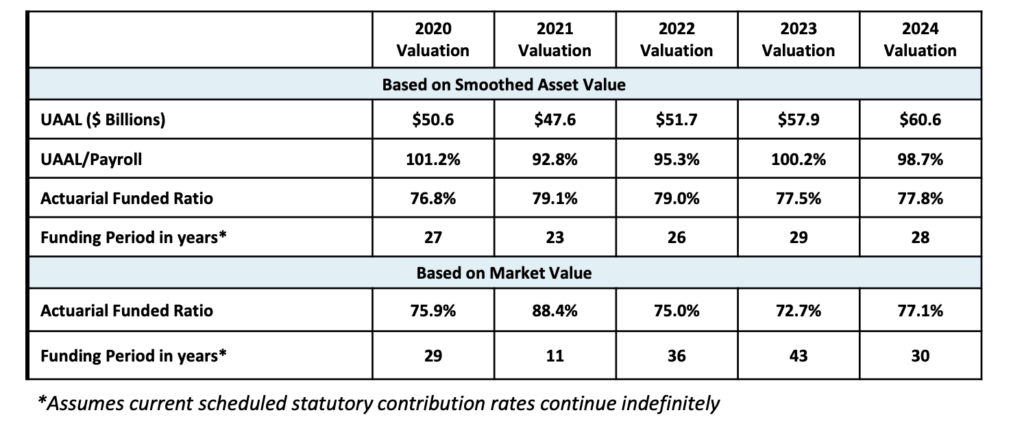

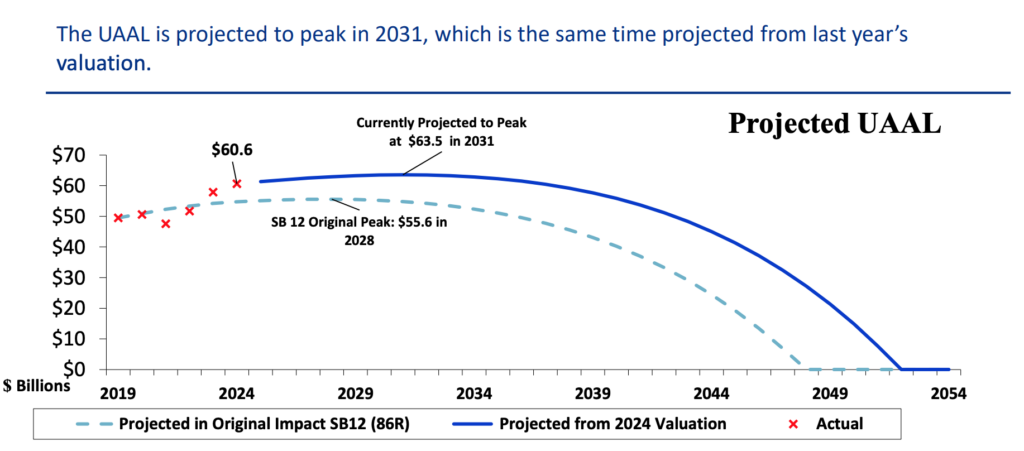

Current assumptions predict the TRS pension fund will reach 100% funded status in 2052. Per the chart below, the funding period is 28 years. The funding period must be less than 31 years for the Legislature to consider possible benefit enhancements.

Unfunded liabilities are expected to grow each year until the funding period gets below 20 years, referred to as negative amortization. The UAAL is projected to peak in 2031. The 2052 date is the date the assets are projected to meet the liabilities, and the pension fund would be considered 100% funded. The actual funding timeline will depend on actual experience, but mainly investment performance, since contributions are set by statute. This assumes contributions from the state, school districts, and active education employees will remain the same.

Active educator membership growth (1.8% this year, 1.3% per year over last decade) continues to be the main positive driver keeping the funding period in check even though liabilities are growing. This year the active membership growth decreased the funding period by two years. Salary increases were larger than expected (primarily in the higher education sector), increasing the UAAL by $1.5 billion more than expected as larger salaries equals larger benefits.

It would take a 0.97% increase in the contribution rate to have positive amortization in fiscal year 2026. This would decrease the funding period from 28 to 23 years and save $27 billion over the amortization horizon.

TRS Releases 2024 Value Report

Dr. Ray Perryman, economist, presented the 2024 TRS Value Report, previously referred to as the Great Value Brochure. This biennial report showcases the positive impact TRS retirees, active members and their benefits have on the Texas economy. This informative document can be shared with your legislators, along with TRTA’s Legislative Priorities.

Reminder: Open Enrollment for TRS-Care Medicare Advantage

Members may recall that a limited time enrollment opportunity is available now that allows Medicare-eligible retirees (and their eligible dependents) to enroll or rejoin TRS-Care Medicare Advantage. The enrollment period began on Oct. 1, 2024, and continues through March 31, 2026.

Thank You!

If you want TRTA to be able to continue our work, please support us today and renew your membership dues! This is how we are able to deploy resources when needed at urgent times. If you are not a member, please join today! It may be the best $35 you spend every year to protect and improve your livelihood and income as we fight for your retirement security!