Executive Summary:

- TRS continues to work on a long-term facilities solution, with a final decision to be made in 2021

- The Indeed Tower space has not yet been sub-leased

- The TRS pension fund’s value increased by $7.4 billion between 2019 and 2020

- Senate Bill 12 (passed in 2019) continues to push the pension plan towards actuarial soundness

- However, no cost-of-living adjustment is on the horizon according to TRS

- New vendors take over the TRS-Care medical insurance plans in January 2021 with no changes in rates or benefits for participants; new insurance cards are being mailed throughout December

The Teacher Retirement System of Texas (TRS) Board of Trustees met Wednesday, December 9 through Friday, December 11 to discuss several critical issues, including long-term facilities planning and the valuation of the pension fund. The board met virtually as the agency continues to work during the COVID-19 pandemic.

During the Wednesday meeting, Nanette Sissney was selected as the 2021 Board Vice-Chair, which serves a vital role within the organization. The Texas Retired Teachers Association (TRTA) would like to congratulate Sissney in serving this role.

Long-Term Facilities Update

On Thursday, December 10, TRS Executive Director Brian Guthrie provided an update on TRS’s plans for a long-term generational solution to house its hundreds of employees. His report showed that the TRS headquarters in downtown Austin can no longer meet the agency’s space needs as the number of staff members continues to grow.

Though many TRS employees are working from home due to the pandemic, work from home isn’t expected to be sustainable for most employees. TRS believes it’s important for members to be able to meet in person with staff when making financial decisions, though currently the state prohibits more than 50% of employees from working onsite on any given day. Once the pandemic is over, TRS projects that about 75% of employees will work onsite and 25% will work from home.

TRS is considering several potential building solutions and is seeking approximately 300,000 square feet to meet its space needs. “The decision must be in the best interests of our members and the fund,” said Guthrie. Guthrie described the need make a “prudent” decision that’s economically advantageous to the fund.

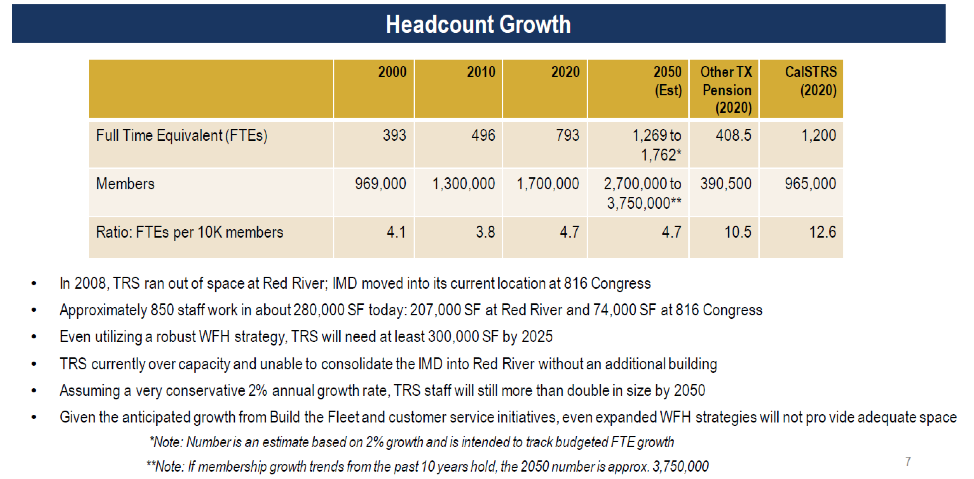

TRS has approximately five employees for every 10,000 members of TRS, which is low compared to its peers. For instance, the California State Teachers’ Retirement System (CalSTRS) has 12.6 employees to 10,000 members.

“We’re doing the best we can with a very efficient workforce,” said Guthrie. The number of TRS members is expected to grow from 1.7 million today to between 2.7 and 3.7 million by 2050, requiring increases in staff over time.

The Texas Legislature doesn’t appropriate funding for TRS to pay its employees. The funding for TRS employees comes out of the pension fund. TRTA appreciates TRS’s communication about its staffing and costs.

However, the Sunset Commission recently said that TRS needs to improve its communication about staff bonuses, and that “currently, that information is not discernible.” TRTA supports financial incentives related to investment returns, but members often read media reports about bonuses without adequate explanation from TRS. TRS should disclose its bonuses annually and move to be more transparent with its members.

The 816 Congress lease, where the Investment Management Division (IMD) employees are housed, hasn’t yet been renewed and is still under consideration. Likewise, the controversial space TRS was planning to lease in the luxury Indeed Tower has not yet been sub-leased. The COVID-19 pandemic has been a major factor impacting these activities. The Indeed Tower space is being marketed aggressively to potential sublessees.

Andrew Roth, TRS Chief Operations and Administration Officer, discussed the importance of timing of the board’s decisions about facilities. He cautioned that deciding not to move forward within a reasonable amount of time means the agency will need to start a new solicitation process in another two or three years, as some of the currently available options will go away.

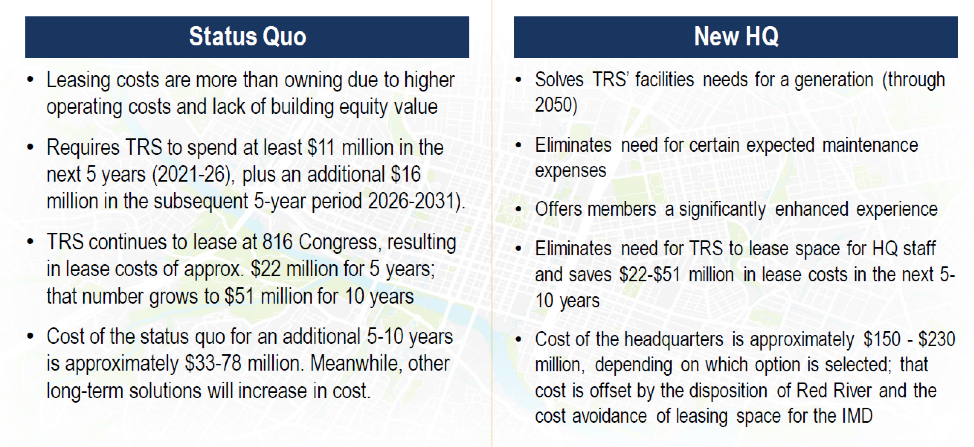

Roth reviewed the cost-benefit analysis of staying in the current building and renovating and maintaining leases for additional space versus constructing a new headquarters that consolidates all employees into one location. While a new building would cost between $150 to $230 million, TRS projects that cost will be offset by disposition of the Red River location and lease costs at 816 Congress.

Director Guthrie recommended to the board that a final decision be made about a permanent building solution in 2021, likely between July and December.

Pension Fund Valuation

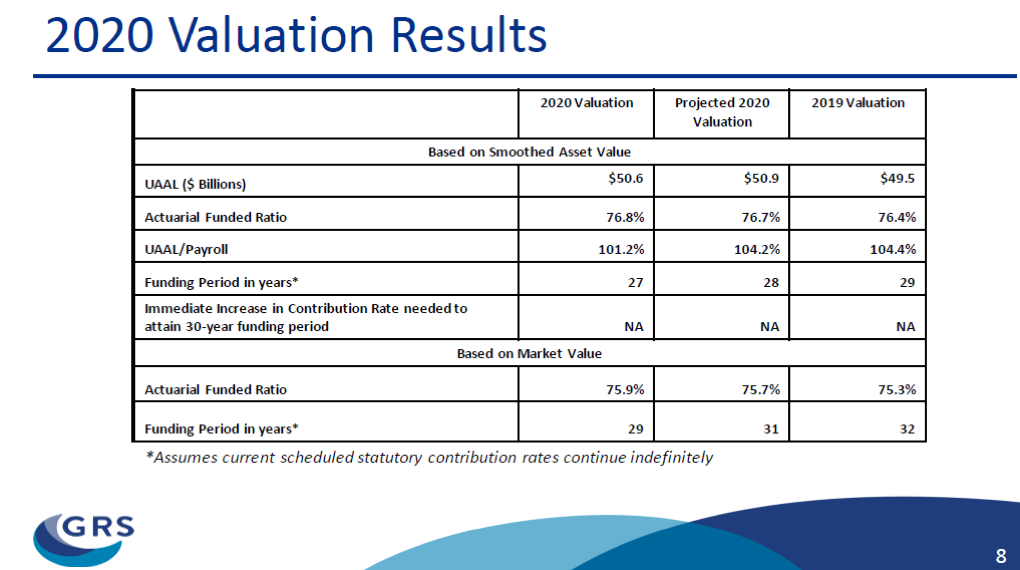

On Friday, December 11, the TRS board reviewed an actuarial valuation of the TRS pension fund that was completed on August 31, 2020 by independent actuary Gabriel, Roeder and Smith (GRS). Representing GRS, actuaries Joe Newton and Dan Sibilik said that this annual valuation was one of the strongest for the TRS system in more than a decade.

The TRS pension fund increased by $7.4 billion, rising from $158 billion to $165.4 billion between August 2019 and August 2020. The estimated market return for the plan year that ended on August 31 was 7.24%. The rate of return assumption was changed last year to 7.25%. This year’s returns almost exactly matched that figure. Investment income totaled $11 billion. The average market return for the system over the last five years is approximately 8.0%, over the last ten years approximately 8.7%, and over the last 20 years approximately 5.9%.

The unfunded actuarial liability (UAAL) increased by $1.3 billion to $50.6 billion, lower than originally projected. Assuming TRS receives the funding as established in state statute, the funding period is 27 years—the lowest its been since 2007.

The projected date for the system to be considered fully funded is one year less than indicated by previous projections. The policies and contribution levels put in place by Senate Bill 12 during the 86th Legislative Session in 2019 continue to put the system on an appropriate path to actuarial soundness and will save the state of Texas $87 billion over the long term, assuming stable market conditions.

As of August 31,2020, TRS had 1,237,434 current members and 445,274 retirees. The number of people who retired in 2020, 20,192 members, was less than the 22,871 members who retired in 2019.

Joe Newton said that the actuarial valuation is “solid,” showing that trends are tracking with previous projections. If all the new statutory contribution levels established in SB 12 continue, the fund is projected to have an increase in the UAAL from the current $50.6 billion to $54.6 billion in 2027, before beginning to decline. The valuation will be updated at the end of February and will be presented to the Texas Legislature.

TRS-Care Valuation

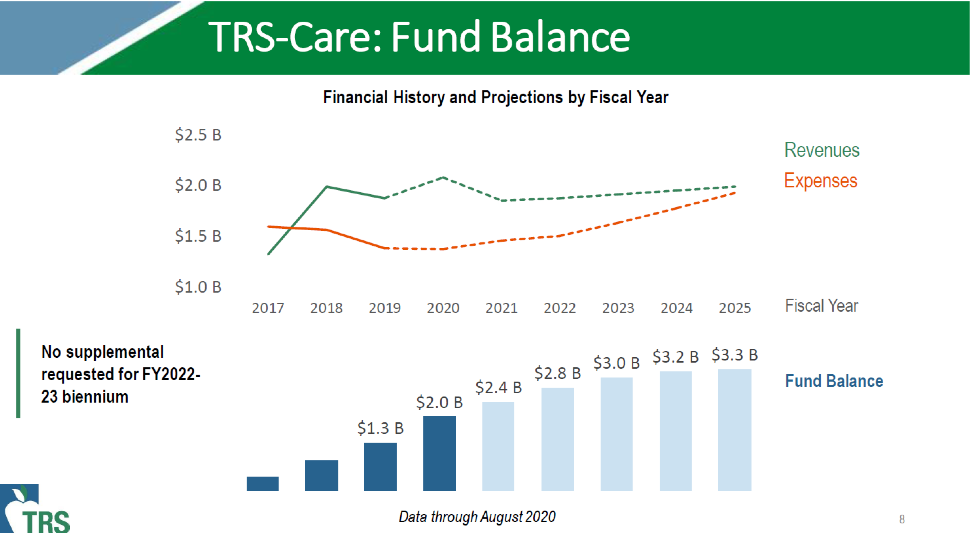

The TRS-Care fund increased by $704 million (from $1.3 billion to $2 billion). Income included the $230 million in supplemental appropriations from last session. Retirees paid $500 million in premiums in addition to co-pays, out-of-pocket expenses, and non-covered charges. TRS-Care membership continued to drop from 225,297 in 2019 to 219,962 in 2020.

TRS Chief Health Care Officer Katrina Daniel cautioned that because the program costs exceed its revenues, this fund balance will be spent by 2025 or sooner. “We aren’t out of the woods for the forseeable future,” she said.

One of solutions the Texas Legislature has discussed to remedy the TRS-Care funding issue has been to pre-fund the plan. However, the figure to prefund TRS-Care is significant. According to Joe Newton, the Texas Legislature would need to increase the state contribution to TRS-Care from 1.25% of active teacher payroll to 2.88% to pre-fund the plan. The state currently funds TRS-Care on a pay-as-you-go basis.

TRTA maintains that basing contributions to the health insurance program on payroll instead of medical costs isn’t a sustainable solution to ensuring the plan’s longevity. TRTA recommends that a long-term plan include funding per TRS retiree that is equal to the Employees Retirement System (ERS) funding per retiree.

In January 2021, the TRS-Care Medicare Advantage plan will transition to United Healthcare and the TRS-Care Standard plan to BCBS TX. TRS says the vendor change will generate $314 million in savings over the next five years. There was also no funding shortfall during the FY 2022-2023 biennium, and plan participants can expect no changes in their rates and benefits for 2021. New insurance cards are being mailed throughout the month of December.

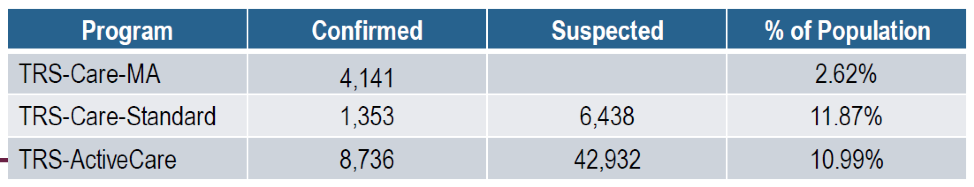

COVID-19 has added $100 million in costs for both TRS-Care and Active-Care. There have been 15,273 confirmed cases among all TRS members as of October 2020.

The next board meeting will occur on February 25, 2021.

Gracias

Thank you for being a member of TRTA and supporting issues that affect retired Texas public school personnel. If you’re not a member already, join us today.

Stay tuned to the Línea interior for additional information as we get closer to legislative session. You can also download the TRTA app to receive all of the latest updates and communicate with your fellow retirees.