The Teacher Retirement System of Texas (TRS) Board of Trustees convened September 14 and 15 for their quarterly meeting. The board discussed various topics including the payment of stipends for eligible TRS annuitants, new appointees to the TRS Retirees Advisory Committee (RAC), and the TRS Fall Health Care Fairs.

Information About Stipends

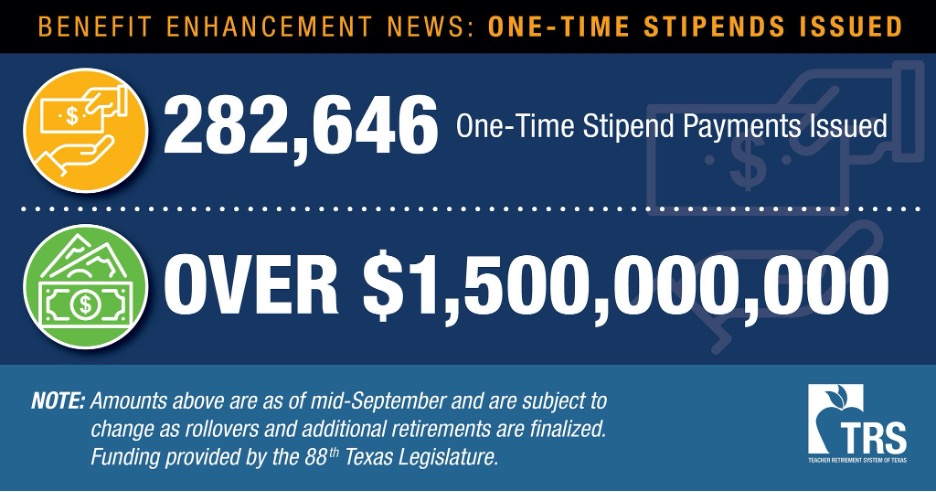

By now, TRS annuitants who are eligible for the stipends approved by the Texas Legislature during the 88th Legislative Session should have received their payments. TRS annuitants who were aged 75 and older as of August 31, 2023 were to receive a $7,500 stipend, and those who were aged 70 to 74 by August 31, 2023 were to receive a $2,400 stipend.

TRTA has received questions regarding the actual stipend amounts received and the taxes that were withheld. TRS sent a letter to those receiving the stipends this summer regarding this matter. However, if you did not receive the letter or misplaced it, the information below may clarify how tax withholdings for your stipend were handled. (More information is available at this link on the TRS website).

- Will the $2,400 stipend be treated as taxable income?

- Yes, the stipend will be treated as taxable income in the year paid. The payment amount will be reported with your annuity payments on your 2023 IRS Form 1099-R or 1042-S.

- How might the one-time stipend affect my September annuity payment tax deductions?

- If you have income tax withholding applied to your September annuity payment, the withholding amount will not be affected by the one-time stipend. Any additional taxes due as a result of the stipend will be deducted from your stipend and not your September annuity payment.

- How will TRS determine my tax withholding for the one-time stipend?

- If you are a U.S. citizen or resident alien, income taxes will be withheld based upon the withholding certificate (Form W-4P or TRS228A) on file with TRS or the default rate.

- Will the $7,500 stipend be treated as taxable income?

- Generally, yes, the stipend will be treated as taxable income in the year the stipend is paid. However, because this stipend is rollover eligible, you may defer the recognition of income tax by electing to roll the amount over to another eligible retirement plan and income tax will ultimately be recognized in the tax year it is distributed from the rollover account. If you do not elect to roll over, then the amount will be taxable in the year it is distributed.

- If I don’t roll over the stipend, how will TRS determine my tax withholding?

- If you do not roll over the stipend, then the stipend is subject to a mandatory 20% rate of income tax withholding.

- Why is TRS required to withhold 20% of the $7,500 stipend?

- Because this stipend is considered an eligible rollover distribution under federal law, different withholding rules apply to the stipend than to other types of payments you may receive from TRS, such as your monthly annuity. The withholding rules that apply to your monthly annuity payment provide more flexible withholding options and even allow you to choose that no income tax be withheld from your monthly payment. However, those options do not exist for the withholding rules that apply to eligible rollover distributions. Instead, the law expressly requires TRS to withhold 20% from all payments that are eligible rollover distributions unless an individual elects to roll over the amount to an eligible retirement plan.

New Retirees Advisory Committee Members Named

The TRS Retirees Advisory Committee (RAC) is an advisory committee for the TRS-Care program. This committee is comprised of seven members appointed by the TRS Board of Trustees. These members serve staggered terms of four years. The RAC meets twice a year for public meetings that cover topics such as: group health coverage, changes and recommendations to plan features, and recommendations to legislation that affects TRS-Care.

The following recommendations were made and approved by the TRS Board: RAC Chair Nancy Byler (retired teacher, TRTA member, TRTA Past President, and TRTA State Legislative Committee member), RAC Vice Chair Dr. Mary Widmier (retired teacher, TRTA member, and TRTA Legislative Coordinator/State Legislative Committee Chair), retired teacher Dr. Mary Ann Whiteker (TRTA member), retired school administrator Tonya Davis, and active teacher Sherry Miller. Congratulations to these individuals and thank you for your service!

Reminder: TRS Hosting Health Fairs This Fall

The TRS Health Fairs are now underway! For additional information, including the dates and locations of the fairs, please visit this link. To register for a TRS Health Fair, please visit this link.