Executive Summary:

- Watch the TRS Board of Trustees Meeting on July 27.

- TRS Board is likely to reduce rate of return assumption.

- Texas will need to increase its contribution to TRS to ensure retirees can receive a cost-of-living increase.

The Teacher Retirement System of Texas (TRS) Board of Trustees are scheduled to meet on July 26-27. The most pressing issue for the board to vote on is the rate of return assumption. The agenda for the meeting is available here. There will be live webcasts for July 26 and July 27.

The Texas Retired Teachers Association (TRTA) believes it is likely that the board will vote to lower the rate of return assumption from 8 percent to 7.5 or, more likely, 7.25 percent.

A change to the rate of return assumption will not impact the current annuity amount retired educators are receiving from the pension fund.

However, a change to the rate of return assumption will alter the trajectory for potential cost-of-living increases for retired educators. The fund’s long-term financial health will also be weakened by a change to the rate of return assumption without action taken during the legislative session.

If the rate of return assumption is lowered to 7.25 percent, it would require the Texas Legislature to increase state contributions by 1.83 percent, which equates to $790 million per year, to put the pension fund within a 31-year funding period.

Once the TRS fund is within a 31-year funding period, it meets the state requirement for providing a cost-of-living increase for retired educators.

Additionally, Texas has a provision that precludes benefit increases from occurring for TRS retirees. The pension system cannot go above a 31-year funding period if or when a benefit increase is approved by the Legislature. If the benefit increase pushes the TRS fund above a 31-year funding period, the proposed increase may not be allowed.

TRS has to have a funding period considerably less than 31-years in order for the Legislature to authorize the fund to provide a permanent increase for retirees.

All of this is purely theoretical as the Legislature has not authorized any pension increases for retirees since 2013. In 2013, the Legislature provided a pension increase for retirees that had retired on 8-31-2004 or before. Those retirees received a 3 percent increase in their annuity capped at $100 per month.

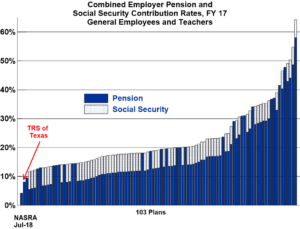

Any retiree who retired 9-1-2004 or after has never received a pension increase. Thousands of retired school employees have seen reduced Social Security benefits (if they receive them at all), increased health care costs, and no pension increases for as long as 14-years in their retirement.

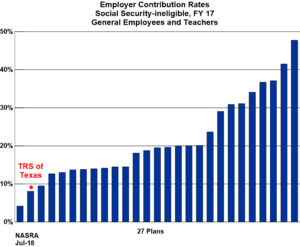

TRS Texas currently receives a 6.8 percent contribution rate from the employer, which is about half as much as the next highest state among its peers. Ninety-five percent of Texas school districts don’t contribute to Social Security. As compared to other state pensions that don’t contribute to Social Security, Texas is receiving a bargain. The average contribution into those other pension systems is 19 percent. The contribution from Texas to TRS is 6.8 percent.

The employer contribution to TRS is comprised of two parts, a 2.8 percent contribution from school districts and a 4 percent contribution provided by the Texas Legislature out of the general revenue fund.

The pure state budget general revenue contribution to Texas TRS is the absolute lowest percentage of payroll contribution to a state TRS pension plan in the nation.

(Click images to enlarge.)

While it may be the lowest contribution as a percentage of payroll in the country, Texas legislators have done far better by our Texas TRS than any other state in the nation has for its TRS public pension plan. The Texas Legislature has NEVER taken a pension funding “holiday,” or the action of not making the employer contribution to the pension fund. Many states are suffering as their elected officials regularly withheld necessary contributions to the pension fund. However, Texas legislators have always made at least the constitutional minimum level of contribution to the pension system in its now 81-year history.

The TRS board has met twice to consider changing the rate of return assumption, once in April and once in February. The April meeting featured a pair of votes by the board to change the rate of return assumption. However, neither vote reached the necessary five votes to pass. The board has been divided on how far to lower the rate of return assumption.

The board has received recommendations from the actuary firm of Gabriel, Roeder, Smith & Co. to lower its rate of return assumption below 8 percent, as the majority of pension funds have moved below this mark.

If the TRS board does lower its rate of return assumption, TRTA is strongly encouraging TRS to pursue additional funds from the Texas Legislature. While state law prohibits TRS from lobbying the Texas Legislature, it is still TRS’s fiduciary duty to ensure that the pension fund is actuarially sound so that members may receive cost-of-living increases.

TRTA is strongly encouraging its members to tune into the live webcast on Friday, July 27. This TRS board meeting will be critical to the future health of the pension fund. Be sure to share this and upcoming editions of the Inside Linewith your fellow retirees!

Be sure to like us on Facebook, follow us on Twitter and subscribe to our YouTube channel.